Electric vehicle (EV) buyers could face sticker shock if the EV tax credit gets repealed. J.D. Power executive director of EV practice Brent Gruber joins Asking for a Trend to explain how the new tariffs and potential loss of incentives could hit EV prices and demand. To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend here.

Trump tariffs on China have been slashed for 90 days. Shipping stocks are rallying on hopes for rebounding activity, but uncertainty remains.

Dillard's (DDS) delivered earnings and revenue surprises of 14.18% and 0.74%, respectively, for the quarter ended April 2025. Do the numbers hold clues to what lies ahead for the stock?

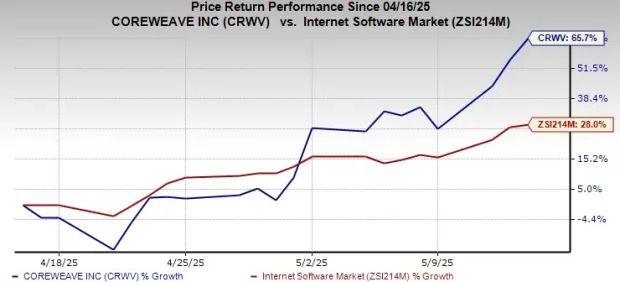

CRWV's performance gains from increasing demand for AI-cloud infrastructure. Management announces increases in capex due to higher investment in the platform.

Household products company Church & Dwight (NYSE:CHD) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 2.4% year on year to $1.47 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $1.5 billion at the midpoint, or 1.3% above analysts’ estimates. Its non-GAAP profit of $0.91 per share was 1.4% above analysts’ consensus estimates.

Investing.com -- On Thursday, Coinbase (NASDAQ:COIN) disclosed a cyber attack involving the theft of internal data and customer information, with a potential financial impact ranging from $180 million to $400 million.

Infrastructure solutions provider Quanta (NYSE:PWR) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 23.9% year on year to $6.23 billion. The company expects the full year’s revenue to be around $26.95 billion, close to analysts’ estimates. Its non-GAAP profit of $1.78 per share was 6.9% above analysts’ consensus estimates.

Railcar products and services provider Trinity (NYSE:TRN) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 27.7% year on year to $585.4 million. Its GAAP profit of $0.29 per share was 9.4% below analysts’ consensus estimates.

American motorcycle manufacturing company Harley-Davidson (NYSE:HOG) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 23.1% year on year to $1.33 billion. Its non-GAAP profit of $1.07 per share was 38.7% above analysts’ consensus estimates.

Is Costco's steady growth and loyal membership base the winning formula, or can Dollar General's bold revamp and real estate push turn the tide?