In an uncanny twist, fear is running high among stock-market investors, despite the S&P 500 sitting not far off its all-time high.

“What happened to sentiment? Everywhere you look, fear has set into the collective mood,” analysts at Bespoke Investment Group wrote in a Thursday note, running down a growing list of indicators reflecting rising fearfulness.

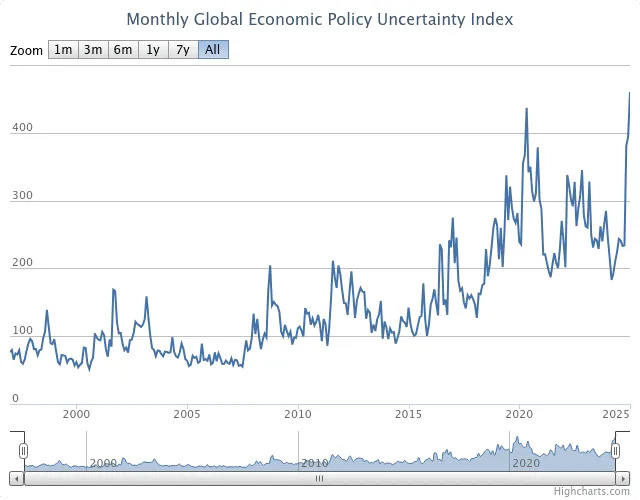

And they mean everywhere. Measures of economic uncertainty — such as the closely followed Economic Policy Uncertainty Index , devised by economists Scott Baker, Nick Bloom and Steven J. Davis — have surged even past levels seen during the height of the COVID-19 pandemic (see chart below).

Stocks slipped Friday after the University of Michigan said its measure of consumer sentiment slipped in February to its lowest reading since November 2023 . And investors didn’t like it Tuesday when the Conference Board said its index of consumer confidence dropped 7 points in February to an eight-month low of 98.3 .

Related: Trump’s tariff push has spooked investors. Here’s what it would take for him to step in to stop the selling.

But it’s the stock market where negative sentiment is clearly the most pronounced, the analysts said.

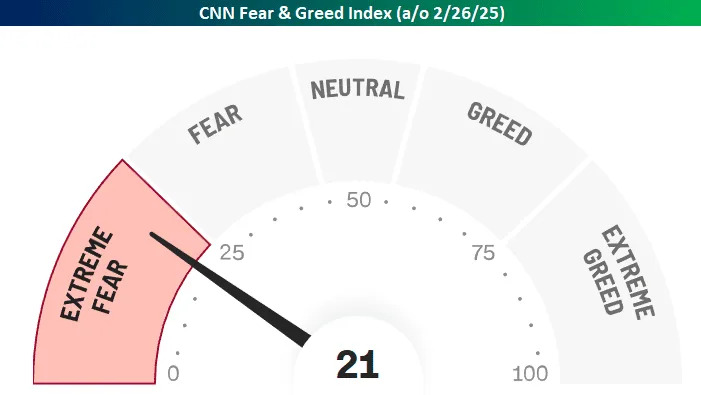

Among widely watched indicators, CNN’s Fear & Greed Index , which is based on momentum, breadth, options activity, the junk-bond market and demand for safe-haven assets, had dropped Thursday morning to 21, a level that reflects “extreme fear.”

And then there’s the weekly survey from the American Association of Individual Investors, which showed that “the bears are out in full force,” the analysts wrote. Bullish sentiment fell from 29.2% last week to 19.4%, the lowest reading since March 2023, when the collapse of Silicon Valley Bank sparked fear around the health of regional banks.

But the surge in bearish sentiment has been even more dramatic, they noted, rising above 60% from 40.5% a week ago for its largest weekly rise since August 2019.

Bespoke observed that over the entire history of the survey, there have only been six other weeks when bearish sentiment was higher — and those have occurred against a backdrop of historic events such as the 1990 recession, Iraq’s invasion of Kuwait, the 2007-09 financial crisis and, most recently, in September 2022, just before the market lows.

Investors know that extreme fear often comes as the market approaches or hits a bottom. After all, one of investing legend Warren Buffett’s most famous pieces of advice is “to be fearful when others are greedy and to be greedy only when others are fearful.”

But what’s remarkable about the current bout of worry is that as of Wednesday’s close the S&P 500 SPX was down by merely 3.1% from its record finish, set just a week earlier on Feb. 19.

“It takes a lot less to strike fear into investors than it has in the past,” the analysts wrote. “If there is one word to describe the state of investor sentiment right now, complacent it is not.”